A heuristic example for Dutching stakes allocation

Dutching stakes allocation is tightly in operationally level connected with the process of Dutching

We know that in a Dutching must be fulfilled next:

s0+s1+s2=S dividing stake, here in 3 minor ones I

nrev=d1*s1=d0s0=d2s2 possible revenue doesn’t depend on outcome II

But where in here coming Dutching stakes allocation?

If we put II. in I. it follows:

nrev=S/(1/d0 +1/d1+1/d2) …………………III

Written differently:

nrev=S/(p0 +p1+p2)

From the above formula, we actually see why Dutching can bring a profit!

p1 +p0+p2 must be less than unity:

p1 +p0+p2 <1

Otherwise, we deal with Dutch book!

For that case, and only for that case is: S/(p1 +p0+p2) > S

From the bookmaker’s point of view, p1 +p0+p2 >1 is conditio sine qua non, a condition without which he, the bookie, would experience guaranteed bankruptcy!

In that case:

S/(p1 +p0+p2) = nrev < S

As we now know, tend to profit in that for punter bad option is called Arb(itrary) betting

The above formula(III.) allows to(again) introduce of so-called compound odds, c.o:

nrev=S*c.o(d.o(0),d.o(1),d.o(2)

where is:

c.o(d.0(1),d.o(0),d.o(2)= 1/(1/d.o(0) +1/d.o(1)+1/d.o(2))

or more practical (in excel) :

c.o=1/3*H(d.o(0),d.o(1),d.o(2)

where H is the harmonic mean

Function c.o, compound odds, allows us to directly determine the revenue from the initial, undivided stake, S !

Concrete example

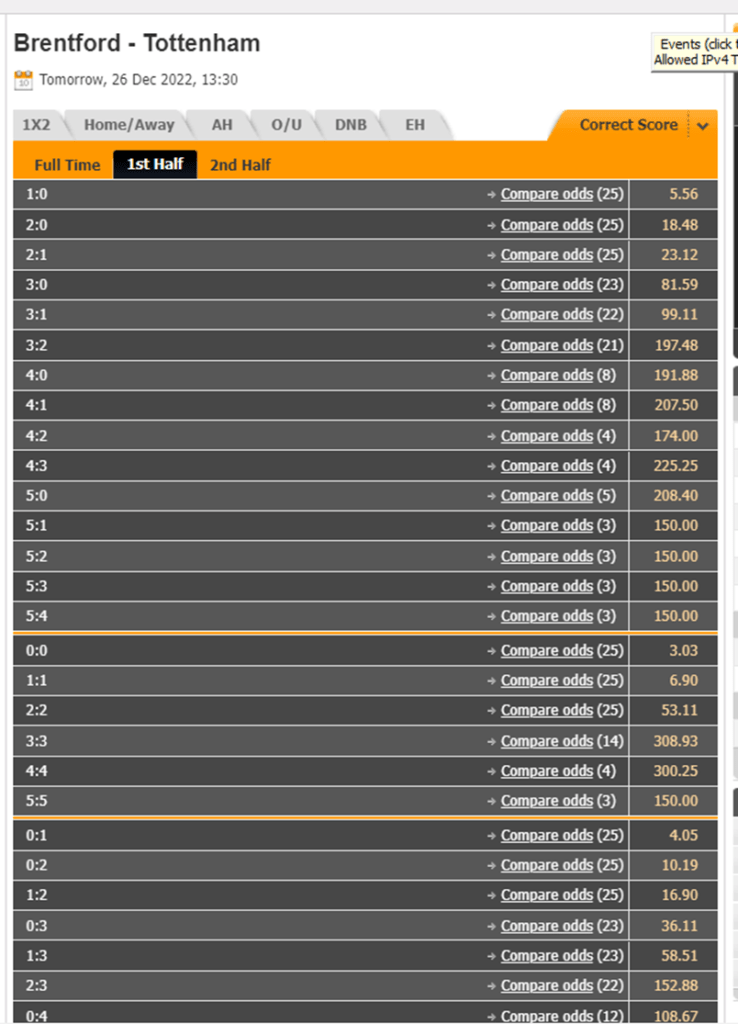

We have the following offer:

From an indeed rich offer, let’s choose 3 of them as possible result in 1-st half:

0-0 ->d.o=3.03

1-0 -> d.o=5.56

0-1 -> d.o=4.05

What is the high possible revenue for that choice, nrev ?

The answer to the previous question gives us compound odds, c.o, as a function of decimal odds by our choice:

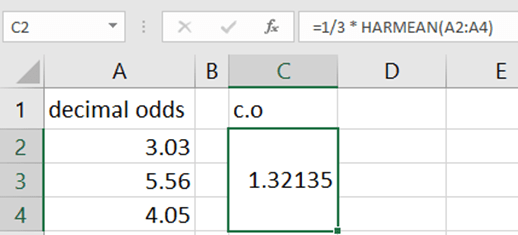

c.o(3.03,5.56,4.05)=1/3 * H(3.03,5.56, 4.05)

On excel:

nrev=S*c.o(3.03,5.56,4.05)=1/3 * H(3.03,5.56, 4.05)

where, as we know, S represents a total stake!

In case the outcome of the first half “falls” within our choice, our profit will be 32.135% of the total stake S

(and it did!

Brentford win 1-half with 1-0)

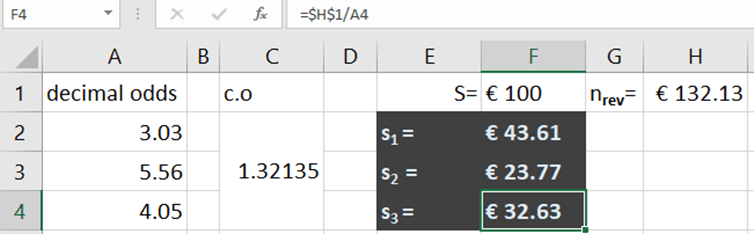

If the bet was S= €100, the problem of allocation of individual stakes still remains!

Because possible revenue doesn’t depend on the outcome, what is written like this:

nrev=d1*s1=d0*s0=d2*s2

The first allocation of total stake S is:

s1=nrev/d.o(1)

This can equally be written as:

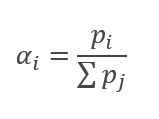

s1=nrev*p(1)= p(1)/(p(1)+p(2)+p(3)

In excel, the whole allocation model looks like this:

Wider case of allocation

Suppose we want to cover up more possibilities!

The procedure is the same but with slightly altered formulas for compound odds!

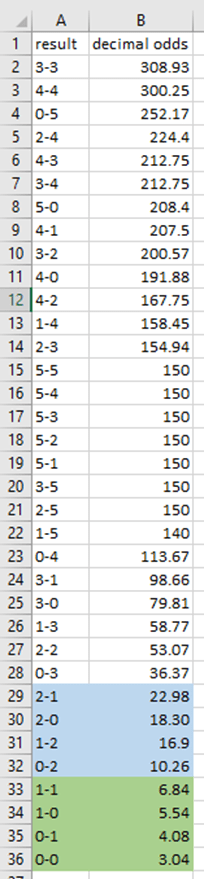

A complete offer of odds for the considered event:

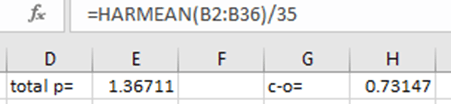

Sum of probabilities for all 35 outcomes is pbookie=1.367106 , so overround is very high, >36%

It isn’t a fair offer!!

So if we cover up all 35 results we will win, of cause but lose 1-0.7314=26.85% of the total stake, S

If we choose the ‘green area’, the lowest 4 coefficients, c.o= 1.110186 so our initial stake will be increased by 11%

the formula for c.o in Excel:

c.o==HARMEAN(B33:B36)/4

Let’s now dive into the pure mathematical analysis of the allocation in Dutching and build the solid foundations on which the above examples are explained

Dutching Formula and Dutching stakes allocation-derivation

Let’s first recall the (almost)necessary terms!

- allocation, α: coefficient for determent amount of particular stake in multiple lays

- dimension, δ: number of partial stakes

- combined odd, c.o : H(x1.x2,…xδ) /δ where:

- xi-particular decimal odd

- H-harmonic mean

- Potential,S: Total investment

- pi=1/xi : implied probability

Recall the definition of Dutching:

Adjusting multiple stakes in a manner that you win equal net income if either your selection win”

Let’s do the math1.

1. Flegenheimer- Bergman’s condition: “Adjusting multiple stakes…”

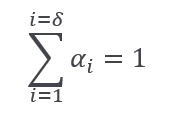

α1*S + α2*S +…. +αδ *S =S => α1 + α2 +…. +αδ =1

From here we got this: ∀i 0<αi < 1 i=1,2,3…δ

2. Flegenheimer- Bergman’s condition:

”…. win equal net income if either your selection win”

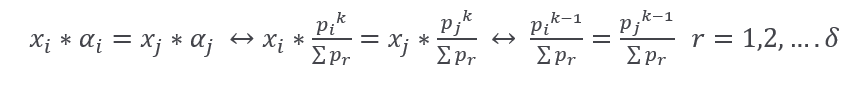

So, ∀i,j αi *S*xi = αj * S * xj

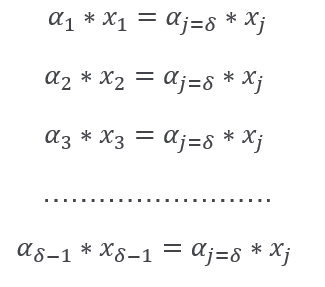

Suppose that j=δ is the largest index!

From 2.fbc we get as follows:

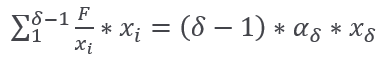

By summing this ‘delta minus one’ equation it follows:

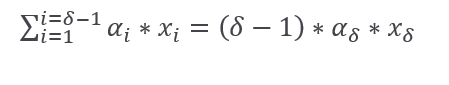

The natural assumption is this:

F in for now unknown term/function!

If the above is valid for i=1,2,3….δ-1 then from 2.fbc we got:

(δ-1)*F=( δ-1)*αδ*xδ

So our assumption (by the principle of the mathematical induction

( 5._th Peano’s Axiom)!) has been correct for any dimension δ !

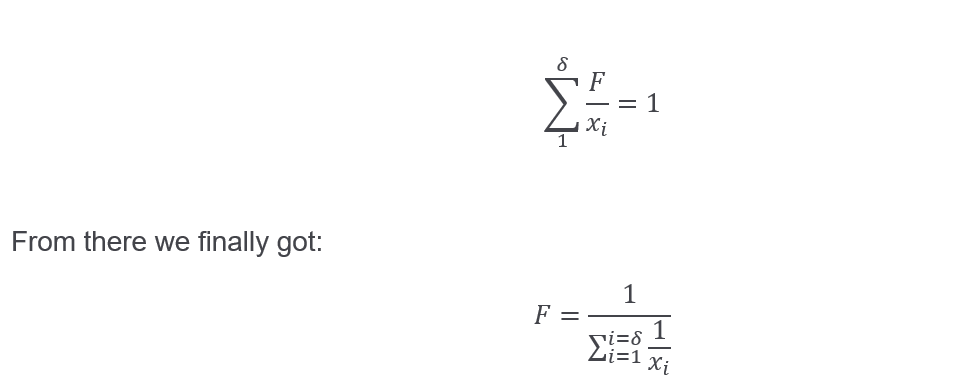

Form of unknown term F we can rich from 1.fbc:

We know that x1,x2…. are odds-so 1/xi is (from odd!) implied probability

Thus we have:

And we got a formula of the same form earlier, for a heuristic example from the introduction of this post!

Let’s go one step further by introducing Allocation Set, AS, set of all function that satisfies 1.fbc

The theorem about the cardinality of the Allocation set

Allocation Set is not finite e.g card[AS] >k , ∀k ∊ N

Proof:

Let t be any element from N( so, natural number)

and take into consideration the following:

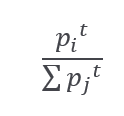

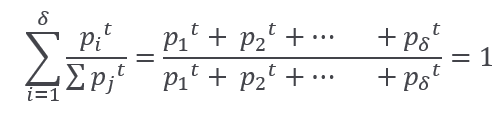

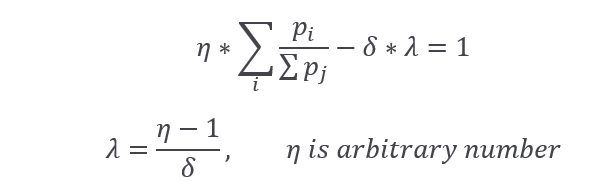

If we sum up the above ratio from i=1 to i= δ we got:

So, we found that:

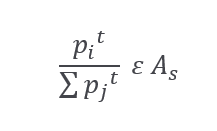

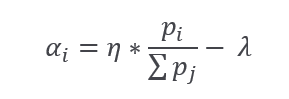

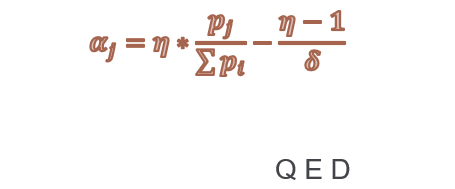

For purpose of continuing the proof of the above theorem, let’s introduce the second main form of allocation:

Putting the above expression in 1.fbc we got:

Following that path, we finally have:

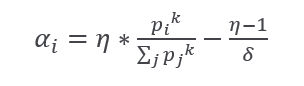

Proof of the above theorem enables follow formulation of the Natural allocation set,NA(η,k) as a set of all αj with the following notation:

T(Basic theorem about Dutching):

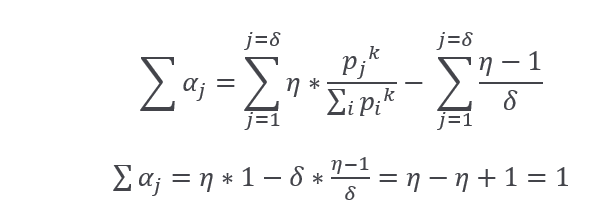

a) only elements from NA(η,k) satisfies condition ∑δαj =1 , j=1,2…δ

b) only elements from NA(1,1) satisfies 2f.b condition

Proof:

a)

b)

Q.E.D